2016 was a transformative year for Hilton as we positioned our business for a new era of value creation while maintaining our position as the fastest-growing global hospitality company on an organic basis. Throughout the year, our team members extended their hospitality to millions of guests, but also supported our efforts to drive positive social impact through our Travel with Purpose investments and initiatives.

Global

RevPAR

Index

Welcomed

guests worldwide

Activated over

$2.5 MILLION

towards our Hilton Disaster Responds Fund, backing communities and team members with long-term rebuilding efforts following a disaster

Loyalty Program grew by

9 Million members

spouses and dependents hired in the United States since 2013, with the goal of 10% of all new hires in the U.S. moving forward

in cumulative savings

from sustainability projects

since 2009:

Energy use by 17%

Water use by 17%

Waste output by 29%

Carbon output by 23%

Connected, prepared, or employed

over HALF-A-MILLION

Young people through

our Open Doors commitment to date

Created nearly

20,000

new hotel jobs

Digital Key is currently

used at a rate of more

than 1 MILLION

times per month

Ranked one of the

TOP 50

Companies for Diversity

by DiversityInc.

One of the world’s

25 BEST

multinational workplaces

by Great Place to Work

Supply

644,622

Pipeline

165,961

Under

Construction

61,265

Supply

76,614

Pipeline

29,792

Under

Construction

16,787

Supply

23,557

Pipeline

33,617

Under

Construction

24,488

Supply

59,304

Pipeline

79,297

Under

Construction

54,636

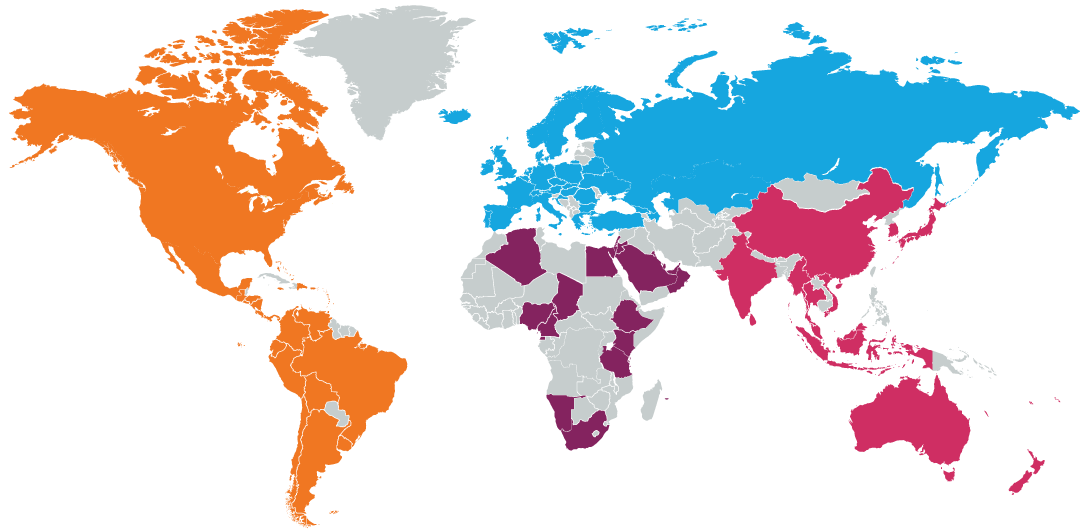

Expanded global

footprint to

104

countries and

territories

Opened nearly 1

Property per day

and expanded our footprint

across five new countries

We have

4 out of 5

of the top hotel brands

in the industry under

construction globally

Current Rooms by Chain Scale

Adj. EBITDA by Business (a)

Adj. EBITDA by Geography (a)

(a)Based on 2016 pro forma Adj. EBITDA giving effect to the spin-off transactions and excluding Corporate and Other