It’s Essential

investment

While acquisitions provide us with substantial expansion opportunities, strategic reinvestment within the four walls of Mohawk is essential to keep pace with evolving market demands and consumer preferences.

Sakiori Linked woven enhanced resilient tile

Strong cash flow funds internal investment, as evidenced through $3 billion in capital expenditures since 2016. These investments, which currently span six product categories and seven countries, allow us to capitalize on rapidly growing flooring categories and new technologies through expanded manufacturing capacity, more efficient capabilities and product innovations. As these investments are fully integrated and optimized, Mohawk expects to reap the benefits through incremental sales and enhanced margins.

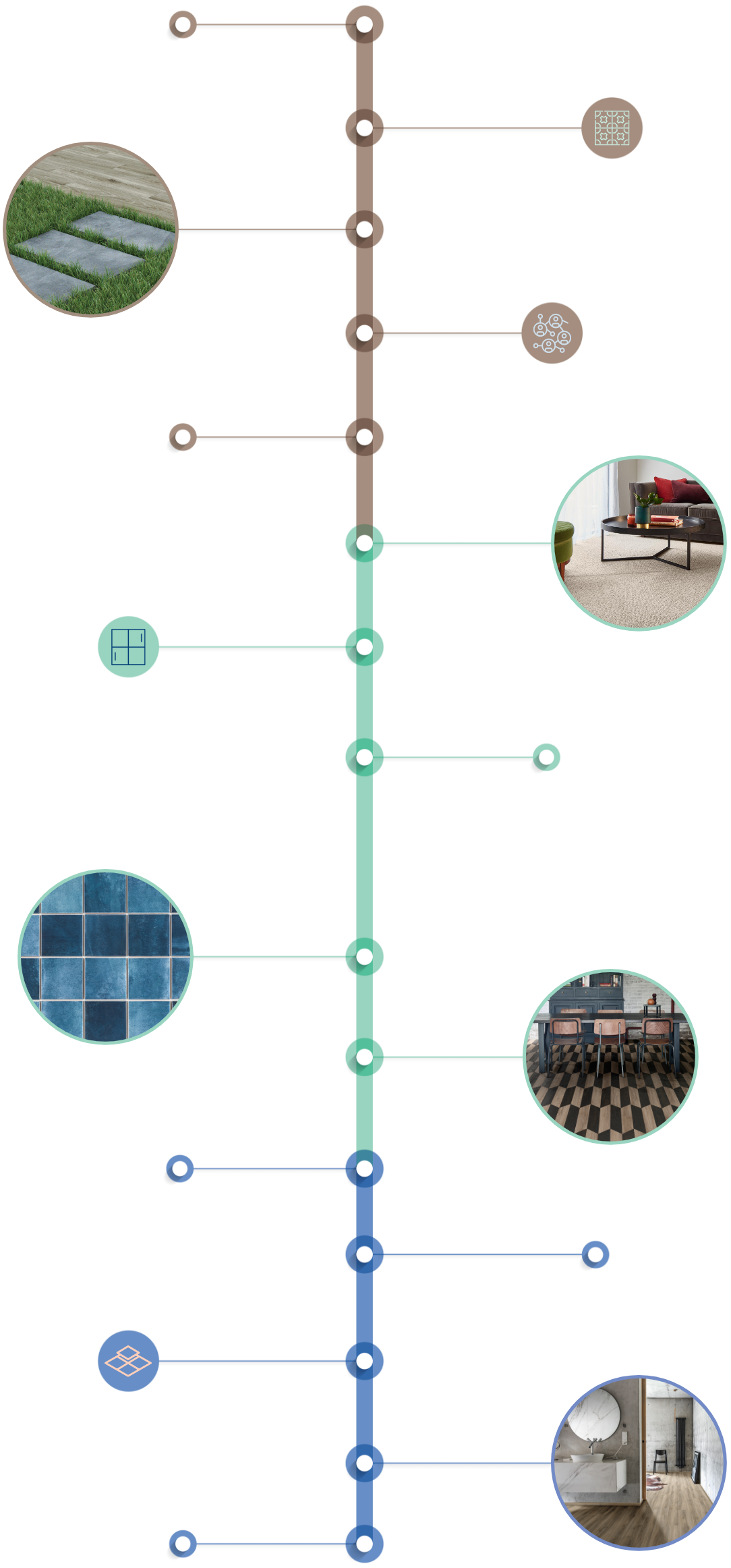

Growth Through Strategic Investment

2017

$900 million in Capex to increase production and expand into new product categories and appealing new markets.

EmilGroup acquisition, an Italian manufacturer that extends leadership in the European ceramic market.

Polcolorit acquisition, a Polish manufacturer that expands ceramic presence into northern and central Europe.

U.S. talc mine acquisition to supply a key material for ceramic tile production.

U.S. nylon polymerization facility purchase to extend vertical integration of carpet and rug manufacturing.

2018

Godfrey Hirst acquisition, the largest flooring manufacturer in Australia and New Zealand to complement existing regional hard surface distribution.

Berghoef purchase, a leading European mezzanine flooring manufacturer to expand position in growing specialty category.

European hard surface distributor acquisitions to increase regional market penetration.

Eliane purchase, a leading Brazilian ceramic tile manufacturer, to enter the world’s third largest ceramic market and serve as a foundation for South American growth.

Expansion of U.S. and European rigid LVT capacity.

2019

Start-up of Russian sheet vinyl plant with European design capability and industry-leading technology to better grow the market’s largest flooring category.

Tennessee plant to initiate production of U.S. quartz countertop, completing comprehensive countertop offering.

Ramp up of European carpet tile manufacturing delivering U.S. soft surface design and technology capabilities to complement commercial hard surface offering.

Capacity expansions in European and Russian premium laminate to extend market leadership through superior water-resistant products.

Expanded ceramic production capacity in Russia, Poland, Bulgaria and Brazil to capitalize on growth markets.