We also know that becoming a trusted partner in our customers’ financial progress means more than simply giving them access to a credit line; it means making it easier for people to save for tomorrow and spend responsibly today. By offering financial products that help our customers make financial progress, we become a trusted partner.

In 2019, Discover won several J.D. Power Awards for the Financial Services sector1, highlighting customer satisfaction with our products. We received awards in the following categories:

#1 in Customer Satisfaction Among Mobile Credit Card Apps and Credit Card Websites

#1 in Highest Customer Service with National Credit Card Companies

Credit Management

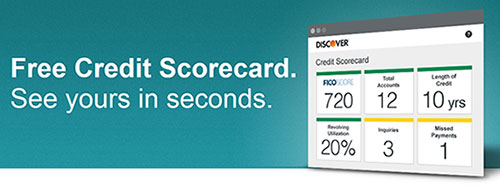

We consider it important that customers know and understand their creditworthiness so they can manage their personal finances and we provide them with the tools to help.

To aid in that knowledge, we offer Discover Credit Scorecard for free to all new, existing and non-customers, which gives them easy access to their FICO® Credit Score.

Student Loan Calculators

Our student loan calculators, available to customers and non-customers, help prospective students and parents understand the full cost of their college education before they take out a loan, which in turn helps them plan how to pay back their student loans. Students and their families can use the calculators to:

- Compare financial aid award letters to understand how much they will pay for college.

- Estimate how much they need to borrow in student loans.

- Estimate monthly student loan payments.

- Estimate how much they might save by making larger loan payments or paying off a loan earlier.

In 2018-19, 163,000 students and their families visited our student loan calculator page on DiscoverStudentLoans.com, helping pave their way to a brighter future.

Rewards for Good Grades

We reward student cardmembers with $20 cash back if their grade point average (GPA) is 3.0 (equivalent) or higher each year they’re enrolled in school, for the first five years from the account opening.

We also reward student loan borrowers for their hard work. A Discover student loan borrower who gets at least a 3.0 GPA (or equivalent) for the academic term covering the loan qualifies for a 1 percent cash reward of the loaned amount on each Discover undergraduate and graduate student loan.

Debt Consolidation

We encourage customers to consider consolidating their debt from other financial service providers with us to give them more clarity around their debt situation and simplify their payments. Our debt consolidation products include:

- Balance Transfers

- Personal Loans

- Home Equity Loans

- Student Consolidation Loans

- Discover received the highest score of the J.D. Power 2019 Credit Card Satisfaction Study and 2019 U.S. Credit Card Mobile App and Online Credit Card Satisfaction Studies of customers’ satisfaction with their primary credit card from a national issuer and their financial institution’s mobile application and online experience for credit card account management. Visit jdpower.com/awards for more information.