CORPORATE INFORMATION

SHAREHOLDER INFORMATION

Additional copies of this annual report, Newell Rubbermaid’s Form 10-K and Joint Proxy/Prospectus related to its 2016 Annual Meeting of Stockholders filed with the Securities and Exchange Commission, dividend reinvestment plan information, financial data and other information about Newell Rubbermaid are available without charge upon request.

CONTACT INFORMATION

All requests and inquiries should be directed to:

Newell Rubbermaid Inc.

Investor Relations

3 Glenlake Parkway

Atlanta, GA 30328

(800) 424-1941

investor.relations@newellco.com

www.newellrubbermaid.com

STOCKHOLDER ACCOUNT MAINTENANCE

Communications concerning the transfer of shares, lost certificates, dividends, dividend reinvestment, duplicate mailings or change of address should be directed to the Transfer Agent and Registrar:

Computershare Investor Services

P.O. Box 30170

College Station, TX 77842-3170

(877) 233-3006

(312) 360-5217

www.computershare.com/investor

This annual report should be read in conjunction with Newell Rubbermaid’s Joint Proxy/Prospectus related to its 2016 Annual Meeting of Stockholders and 2015 Form 10-K. Copies of the documents may be obtained online at www.newellrubbermaid.com.

MARKET FOR REGISTRANT’S COMMON EQUITY AND RELATED STOCKHOLDER MATTERS

The Company’s common stock is listed on the New York Stock Exchange (symbol: NWL). As of January 31, 2016, there were 10,405 stockholders of record. The following table sets forth the high and low sales prices of the common stock on the New York Stock Exchange Composite Tape for the calendar periods indicated:

| 2015 | 2014 | |

| Quarters |

High

Low

|

High

Low

|

| First |

$

40.37

$

36.33

|

$

32.54

$

29.14

|

| Second |

42.00

37.95

|

31.61

28.27

|

| Third |

44.51

38.17

|

35.25

30.85

|

| Fourth |

50.90

39.39

|

38.73

31.14

|

The Company has paid regular cash dividends on its common stock since 1947. For 2015, the Company paid a quarterly cash dividend of $0.19 per share in each quarter. For 2014, the Company paid a quarterly cash dividend of $0.15 per share in the first quarter and $0.17 per share in each of the second, third and fourth quarters. The payment of dividends to holders of the Company’s common stock remains at the discretion of the Board of Directors and will depend upon many factors, including the Company’s financial condition, earnings, legal requirements and other factors the Board of Directors deems relevant.

FORWARD-LOOKING STATEMENT

We discuss expectations regarding future performance, events and outcomes, such as our business outlook and objectives, in this annual report. All such statements are “forward-looking statements,” and are based on financial data and business plans available as of the date of this annual report, which may become out-of-date or incomplete. We assume no obligation to update any forward-looking statements as a result of new information, future events or other factors. Forward-looking statements are inherently uncertain and investors must recognize that actual results could be significantly different from our expectations. Risks and uncertainties that could cause results to differ from expectations are detailed in Item 1A of Newell Rubbermaid’s Annual Report on Form 10-K for the year ended December 31, 2015, and in our other filings with the Securities and Exchange Commission.

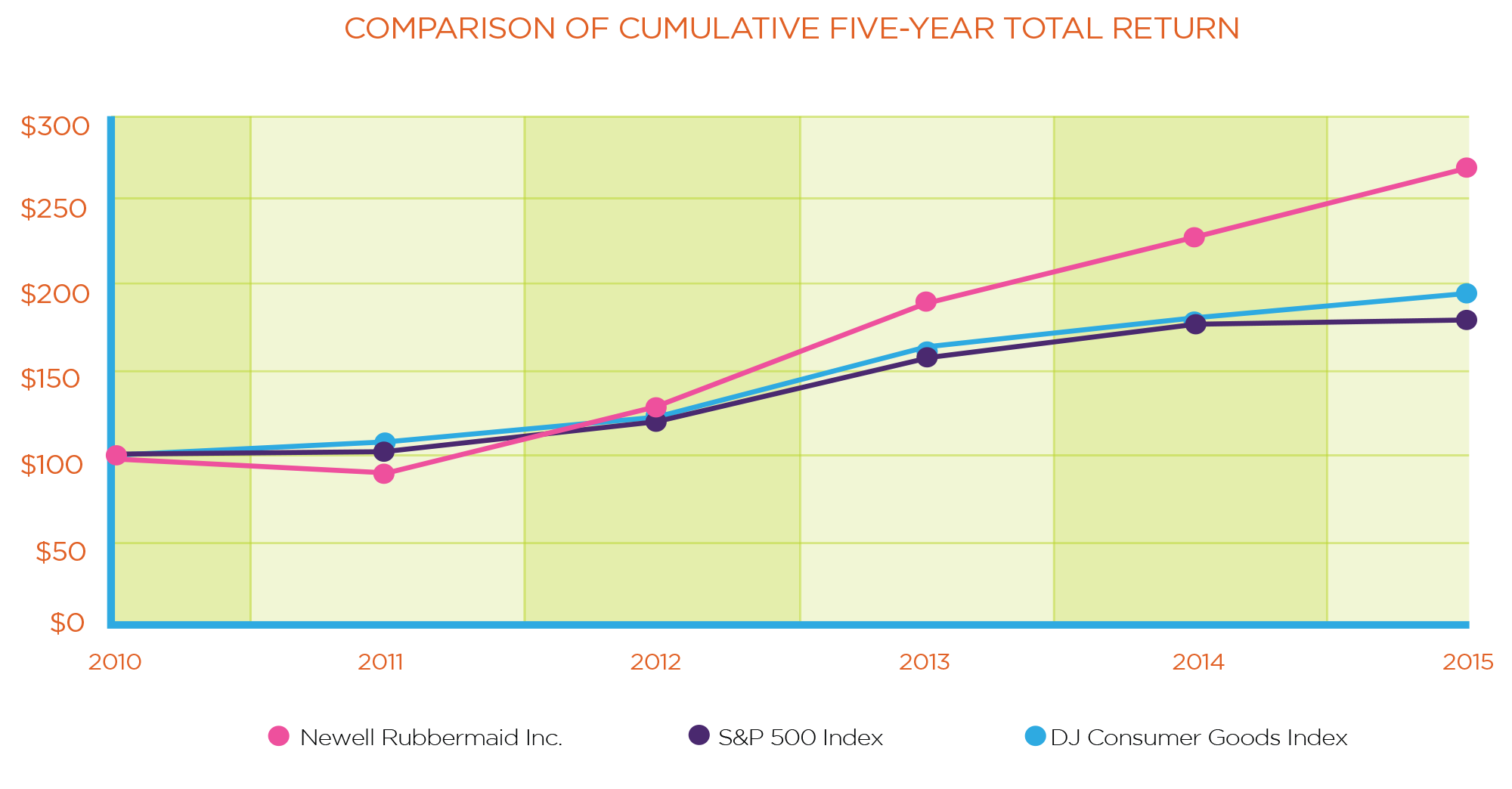

COMMON STOCK PRICE PERFORMANCE GRAPH

The following common stock price performance graph compares the yearly change in the company’s cumulative total stockholder returns on its common stock during the years 2011 through 2015 with the cumulative total return of the Standard & Poor’s 500 Index and the Dow Jones Consumer Goods Index, assuming an investment of $100 on December 31, 2010, and the reinvestment of dividends.

| 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | |

| Newell Rubbermaid Inc. | $100 | $ 90.45 | $127.53 | $189.87 | $227.69 | $268.38 |

| S&P 500 Index | $100 | $102.11 | $118.45 | $156.82 | $178.29 | $180.75 |

| DJ Consumer Goods Index | $100 | $108.80 | $122.73 | $160.22 | $179.62 | $190.48 |