Reflecting on Regions’ accomplishments in 2015, we have never been more confident that we have the right strategy, the right bankers serving the right markets, and the right organizational culture to build on our strong foundation and elevate our performance going forward.

Historically, services offered by banks have included providing financing, holding investments and deposits and facilitating payments. Customer relationships are paramount in achieving success in each of these services. In our current operating environment, it is crucial that we have a focused strategy and a clear perspective about what products, services and markets are the best ones for Regions and our stakeholders. For that reason, even as we embrace innovation and explore new channels and opportunities to reach customers, we remain committed to certain core beliefs about how to run our business.

We believe that, fundamentally, banking remains a people business. When it comes time for customers to make their most important financial decisions – like buying a home, planning for retirement, launching a new business or funding a child’s college education – they want to work with a trusted financial expert who understands their needs and cares about their financial future. Providing that personalized expertise remains as relevant today as ever.

Further, we succeed when we put customer needs at the center of our work every day. Our needs-based approach to relationship banking, which we call Regions360SM, allows us to build trust, expand relationships with existing customers and earn the business of new ones. When we talk to Regions customers – whether it is a young family or a large business customer – we often hear about the many instances where our associates exceed their expectations. However, the evidence is more than anecdotal; there are many empirical measures of Regions’ success on this front. Last year Regions ranked highest for customer satisfaction among all retail banks in the 2015 American Customer Satisfaction Index (ACSI) Report, and was also recognized as a top decile performer in the Temkin Group’s customer experience rankings of U.S. businesses. Moreover, the performance of our bankers earned Regions the designation of Most Reputable Bank in a 2015 research study by the Reputation Institute and American Banker magazine.

Being selective about the markets we operate in, and understanding those markets thoroughly, is another focal point of our operating philosophy. We believe our geographic footprint is one of our greatest advantages. Spanning the South, Midwest and Texas, we serve some of the highest growth markets in the country. Our service area features many positive trends in categories such as job growth, trade volumes and manufacturing expansion. In fact, nearly 40 percent of U.S. Gross Domestic Product (GDP) is generated within our footprint. And, most important, in each of these markets our bankers are deeply engaged in community and philanthropic initiatives and closely connected to business and civic leadership.

A strong commitment to diversification is also core to how we operate our business responsibly. Diversification by market, by product, by industry segment and by customer segment helps manage risk and strengthen our performance throughout the economic cycle. Revenue diversification is also an important part of our growth strategy and will be fundamental to our future success. Investing in initiatives that grow revenue sources from a variety of product offerings will provide our company a broader and more stable source of income.

Most important, and at our company’s foundation, is our belief that in order to build a high-performing, sustainable business we must create shared value for all our stakeholders: customers, associates, communities and shareholders. The success of each stakeholder group is essential to achieving our organizational objectives. That is why all of the decisions we make are guided by our commitment to creating shared value, a process which, in turn, helps build a strong, winning culture within our organization.

Throughout 2015 we remained focused on executing our strategic initiatives, and Regions performed well despite market conditions that were challenging in several ways – most notably a persistently low interest rate environment. While the U.S. economy is slowly improving, there are clearly significant pressures from the global economy.

The fundamentals of our business were positive across the board: We grew loans, checking accounts, deposits, customers, households and credit cards. Growth in these categories enabled us to reach our goal of increasing total revenue. For the year, net income available to common shareholders totaled $1 billion and diluted earnings per common share from continuing operations were $0.76.

As of year-end, Regions achieved total loan growth of 6 percent(1), driven by our needs-based relationship banking approach. Commercial and industrial loans were strong contributors to expanded lending, which comprises 44 percent of our total loan portfolio. Our business model that pairs local bankers with industry specialists contributed to growth throughout our specialized industries group. Within our consumer lending portfolio loan growth was broad-based, with increases recorded in every category. Notable contributors were indirect auto lending, with loan balances totaling $4 billion at year-end. In 2015 we also realized a healthy 4 percent(4) growth in adjusted non-interest income, with strong contributions from Wealth Management, card and ATM fees, and capital markets services.

A prudent risk management discipline is one of our foremost responsibilities, and in 2015 our asset quality metrics remained sound. Non-accrual loans as a percentage of overall loans were 0.96 percent at year-end. Additionally, net charge-offs declined 22 percent and represented 0.30 percent of average loans. Overall economic trends across our markets were generally positive in 2015. However, Texas and the Gulf Coast experienced some pressure in a number of commodity-based sectors, particularly the oil and gas industry. Persistently low commodity prices have negatively impacted many of the energy businesses we serve. We are staying close to these customers as they take appropriate actions to lower costs and reduce debt, and will continue to manage through these situations as constructively as possible.

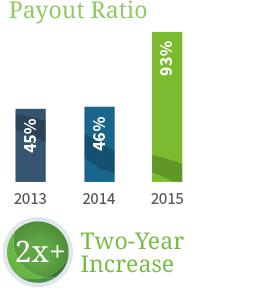

Turning to capital deployment strategy, in addition to funding organic growth and strategic investments, an important priority is returning value to shareholders. In 2015 we returned $927 million to our owners in the form of quarterly dividends and common share repurchases representing 93 percent of net income available to common shareholders. Going forward we will continue to deploy our capital effectively through organic growth along with returning an appropriate amount of capital to our shareholders. Additionally, we will use capital to invest strategically in initiatives to increase revenue or reduce on-going expenses.

In the fourth quarter of 2015 the Federal Reserve implemented its first rate increase in nearly a decade, and while this is a positive for our business, rates remain low by historical standards. We expect the pace of future interest rate increases to be slow and measured. Given that backdrop, we have renewed our focus on an area which is clearly within our control – expense management – and have adopted a plan to eliminate $300 million in core expenses over the next three years to reinvest in our business. This target translates to approximately 9 percent of our adjusted expense(4) base.

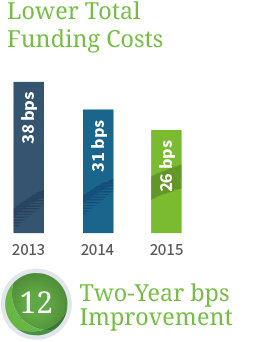

Over the past several years we have taken meaningful steps to reduce expenses, including consolidating more than 20 percent of our branches since the financial crisis. Today we see additional opportunities to operate more efficiently – by leveraging technology to reduce manual processes, rationalizing staffing levels, especially in non-customer-facing areas, implementing additional branch consolidations where appropriate, and reducing third-party and discretionary expenditures.

Our objective goes beyond expense control; it also encompasses growth through innovation. As we operate more efficiently we will reallocate much of those savings to initiatives designed to grow and diversify revenue, with a particular emphasis on areas such as capital markets, treasury management, Wealth Management and insurance services, where we see compelling growth opportunities. We will also continue to explore new innovative initiatives such as point-of-sale lending in collaboration with GreenSky® which offers convenience while meeting consumer needs in the home improvement space, and online lending solutions for small businesses through FundationTM. Over the long term we seek to realize a compound annual growth rate of earnings per share of 12-15 percent and adjusted return on tangible common equity of 12-14 percent. Our expense control and growth initiatives will play a central role in achieving this objective.

We will also continue to build a strong culture, which is fostered by more than 23,000 associates with a passion for serving customers. Our effort to create a more engaged workplace was recognized last year when Regions received Gallup’s Great Workplace Award, one of only 40 companies worldwide to be honored for success in creating an engaged culture. I am proud that we have some of the best bankers in our industry working every day to provide the advice, guidance and education our customers need to make wise decisions that improve their financial wellbeing.

Despite the many changes underway in the financial services industry, we continue to strongly believe that there is a tremendous need in our communities for a bank centered on relationships and people. Because of the expertise and passion of our associates, we are uniquely positioned to be that provider.

I am grateful to each of our associates for their hard work and commitment, and to our Board of Directors, our customers and shareholders for their continued support.

Sincerely,

Grayson Hall

Chairman, President and Chief Executive Officer

(1) Adjusted for the reclassification of $834 million of certain leases out of loans into other earning assets at year-end. For further detail see page 19 in the fourth quarter 2015 supplement.

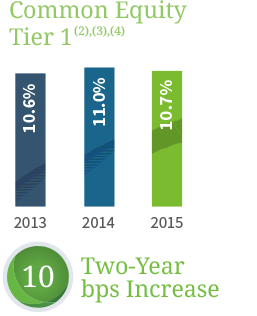

(2) Current year ratio is estimated.

(3) Represents fully phased-in pro-forma ratio. Regions’ prior year regulatory capital ratios have not been revised to reflect the retrospective application of new accounting guidance related to investments in qualified affordable housing projects.

(4) See table 2 in Form 10-K for GAAP to non-GAAP reconciliations.