As part of our Growth Game Plan strategy, we have assigned each of our businesses specific portfolio roles based on their growth prospects and right-to-win in emerging markets. Dubbed “Win Bigger,” our Writing, Tools and Commercial Products segments will be the key drivers of accelerated growth and geographic expansion. In 2014 these three businesses, which represent nearly 60 percent of the portfolio, delivered combined core sales growth of 7.3 percent. The Win Bigger segments have been our first priority for brand-building and capability investments, and their success gives us reason to believe in the promise of a faster-growing, more global, more profitable Newell Rubbermaid.

Our Writing segment’s portfolio of brands is the share leader in a global, highly fragmented, $19 billion retail market. Our strong brands such as Sharpie®, Paper Mate®, Expo® and Parker® position us well for sustainable growth and continued market share gains, particularly in emerging markets where incomes are rising and educational tools such as writing instruments are increasingly valued.

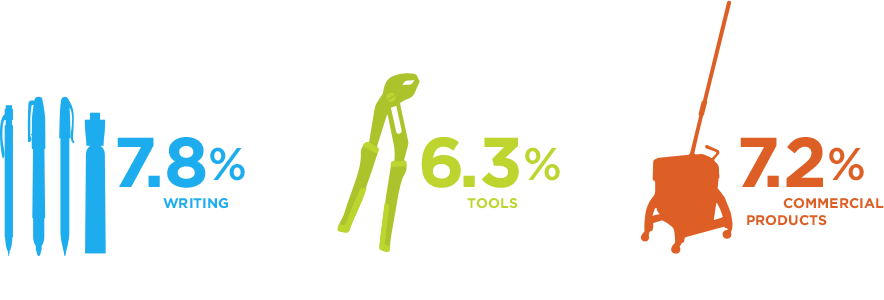

In 2014, the Writing segment grew core sales 7.8 percent, led by strong double-digit core growth in Latin America and healthy mid-single-digit growth in North America. We significantly increased advertising and marketing support for our global Paper Mate® InkJoy® platform, which has fueled distribution gains and increased consumer demand. In both North America and abroad, we drove category growth and gained market share during the critical Back-to-School seasons with strong sell-in and good replenishment orders thanks to compelling innovation, exciting advertising and better in-store placement and merchandising.

With leading brands such as Irwin®, Lenox® and Rubbermaid® Commercial Products, our Tools and Commercial Products segments will continue to benefit from the ongoing infrastructure build out in the developing world and a global focus on hygiene and health. These businesses are growing nicely in the emerging markets, most notably Brazil and China, and their relatively small market shares, combined with solid innovation and investments in marketing, sales and manufacturing, give them plenty of runway for continued strong growth, even in the face of slowing macros.

In 2014, core sales in the Tools segment rose 6.3 percent, reflecting strong global growth, including a double-digit core increase in Latin America. These results were supported by robust marketing campaigns, including our global National Tradesmen Day events and enhanced in-store merchandising. In Brazil, Irwin successfully expanded its product offerings to 19 categories and gained additional distribution.

The Commercial Products segment grew core sales 7.2 percent in 2014, fueled by pricing and strong innovation in our core cleaning, material handling and waste product categories. Key new products include vented Rubbermaid® BRUTE® containers that require less lifting force to remove the liners and the Rubbermaid HYGEN™ Disposable Microfiber cleaning system that filters out 99 percent of microbes.