In 2014, Newell Rubbermaid delivered a strong set of full-year results with solid core sales growth, increased normalized operating margin and record-level normalized earnings per share. We achieved this performance despite some significant headwinds — including the negative impact of the strengthening U.S. dollar and the choice to exit some of our less-attractive product lines and businesses. This result in the face of adverse conditions gives me great confidence that we have proven ourselves to be a much stronger and more resilient company.

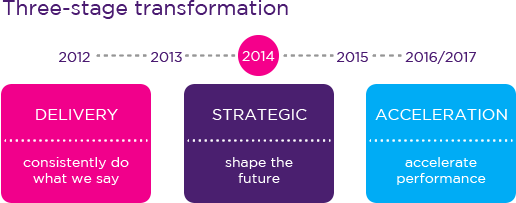

Having now established a track record of consistent delivery, we are building momentum as we progress through the second phase of a three-phase transformation under our Growth Game Plan strategy. In the Strategic phase, we are investing in core activity systems critical to our business success and establishing an operating company structure that releases the full potential of our $6 billion business.

We continue to unlock trapped capacity for growth through Project Renewal, our multi-year cost savings initiative, reinvesting much of the savings in new capabilities and brand building to drive accelerated growth. We have also strengthened our portfolio, spending $600 million to acquire businesses complementary to our core portfolio that are accretive to growth, operating margin and normalized earnings per share. At the same time, we announced the exit of $125 million of less attractive, non-strategic sales. And we continued to return significant value to shareholders, spending over half a billion dollars on share repurchases and increased dividends.

In the Strategic phase, we

are investing in core activity

systems critical to our business

success and establishing an

operating company structure

that releases the full potential of

our $6 billion business.

Winning Bigger to Deliver Strong Results

In 2014, Newell Rubbermaid’s core sales grew 3 percent, despite approximately 60 basis points of negative impact from planned exits of non-strategic business in Europe, Middle East and Africa and in our Rubbermaid Consumer storage business. Normalized gross margin increased 90 basis points to 38.8 percent, enabling a 70 basis point increase in advertising and promotion investment as a percentage of sales. Even with this increased investment, normalized operating margins expanded 40 basis points to 13.8 percent. Normalized earnings per share grew 9.9 percent to $2.00, an all-time high for Newell Rubbermaid, and operating cash flow increased to $634 million.

Our Win Bigger businesses — Writing, Tools and Commercial Products — led our performance with combined core sales growth of 7.3 percent. These segments, which are the major drivers of future company growth and our first priority for expansion in faster-growing emerging markets, have benefited from significantly increased investment behind our brands and stronger innovation. Writing segment core sales increased 7.8 percent, led by double-digit core growth in Latin America and mid-single digit core sales growth in North America. These results were fueled by strong innovation, expanded distribution and increased advertising support with activity across all our major brands, including the launch of Sharpie Clear View® Highlighter, the relaunch of Mr Sketch® scented markers and ongoing support of our Paper Mate® InkJoy® platform. Tools segment core sales improved 6.3 percent, driven by solid growth across all geographic regions, including double-digit core growth in Latin America due to the ongoing success of our expanded product offerings under the Irwin® brand and a year of strong growth for the Lenox® brand. Commercial Products’ core sales grew 7.2 percent, reflecting pricing and strong volume growth in North America as we supported key product lines such as Brute® trash cans and Rubbermaid® HYGEN™ microfiber, as well as distribution gains in emerging markets such as Brazil and China.

In a few short years,

Newell Rubbermaid has

become a faster-growing

and leaner business,

investing in our brands

at record levels and

winning in the

marketplace in the

U.S. and overseas.

Our Business Model Is Gaining Momentum

The success of our Win Bigger businesses gives us increasing confidence that our new business model is working. Newell Rubbermaid is in the midst of transforming from a holding company to an operating company, from a loose federation of independent businesses to a single, coherent organization that harnesses the scale of a $6 billion company. This enables us to place more strategic bets and allocate resources more dynamically to those businesses, brands and initiatives with the greatest right to win. Our unwavering focus on reducing structural and overhead costs and reinvesting those savings into brand building and enhanced capabilities have already contributed to improved performance, and that trend should continue to accelerate as we move through 2015 and into the Acceleration phase of the Growth Game Plan in 2016 and beyond.

Strengthened investment in our brands coupled with stronger innovation will be key to that outcome. In 2014, we significantly increased our brand-building investment, nearly doubling our advertising spend versus the prior year. This step up in spending helped drive market share gains and increased point-of-sale growth across our portfolio, including key brands such as Sharpie®, Paper Mate®, Expo,® Mr Sketch®, Irwin®, Lenox®, Rubbermaid® Commercial Products and Graco®. With the consolidation of multiple creative agencies into one and a more disciplined marketing approach, the quality of our advertising has improved significantly, testing amongst the best across all industries. Of the 14 major advertising campaigns executed in 2014, over 85 percent garnered the top box test scores for both consumer persuasion and awareness, two key predictive metrics of success. That rate is double the industry norm. So not only are we winning on the quality of our innovation ideas, we are now amplifying them with outstanding advertising that is driving consumer awareness and trials. We have coupled this step change in advertising creative quality with increased media buying efficiency by consolidating all of our global media buying into a single agency, another example of leveraging our scale across brands to maximize our return on marketing investment.

Our investments in winning capabilities are also starting to pay off. We significantly increased the resources dedicated to consumer research and insights and revamped our new product development process. In early 2014, we opened a state-of-the-art design center. This will further the development of new ideas that distinguish our brands in the marketplace and help establish design and innovation as a competitive advantage for Newell Rubbermaid. The combined result of these efforts is a much stronger innovation funnel with fewer, but better quality and higher value ideas. Our ambition is to build products and innovation that deliver superior design and product performance. We took a big step forward in 2014 and expect the momentum to continue to build in 2015.

The key enabler for generating these investment funds is Project Renewal. In late 2014, we announced the third phase of the program, designed to release costs in the areas of procurement, manufacturing and distribution, and through further overhead reduction. The company expects to deliver approximately $200 million in incremental savings by significantly reducing complexity in the business and simplifying the company’s approach to bringing products and programs to market. Project Renewal in total is on track to generate cumulative annualized savings of $470 million to $525 million when fully implemented by the end of 2017, the majority of which will be reinvested back into the business to help drive accelerated growth and performance.

Strengthening the Portfolio

We continue to strengthen our portfolio, pivoting the business towards higher-growth, higher-margin opportunities while simultaneously exiting businesses that offer less strategic potential. In 2014, we made three acquisitions that are accretive to growth, normalized operating margin and normalized earnings per share, and bring significant strategic value to the Newell Rubbermaid portfolio. The acquisitions of the Contigo® and bubba® brands, leaders in the on-the-go beverage container market, strengthen our Home Solutions business and give us access to this fast-growing, on-trend category. These top brands, which are differentiated by consumer insight-driven design and patent-protected product functionality, complement our Rubbermaid food storage and beverage business and establish us as a leading player in the on-the-go hydration and thermal beverage categories in North America.

We also acquired Baby Jogger, a leading designer and marketer of premium baby strollers. The Baby Jogger® brand and City Mini®, City Select® and other sub-brands are the perfect premium complement to our industry-leading Graco® brand, providing a great opportunity for Newell Rubbermaid to participate more fully in this fast-growing segment of the market. With sales in more than 70 countries, Baby Jogger will also help scale the Baby segment’s geographic footprint outside North America.

We exited approximately $25 million of non-strategic sales in our EMEA region, simplifying our operations for increased profitability and focusing our resources for growth on the most attractive country-category combinations. As a result, our 2014 normalized operating margins in EMEA increased 580 basis points versus last year to 14.7 percent, equal to our normalized margins in North America.

In our Home Solutions segment, we have made tough choices to reposition the Rubbermaid Consumer business for profitable growth by pulling back on certain low-margin product lines. And we announced our intentions to exit our Calphalon® Kitchen Electrics and outlet stores and the Endicia® online postage business.

More Opportunity Ahead than Behind

The progress we have made so far as we successfully drive the Growth Game Plan into action has created significant value for our shareholders. Our consistently strong cash flow has enabled us to reward shareholders with a return of capital through share repurchases and steady dividend increases.

In 2014, we allocated $546 million to share repurchases and dividend payments. We also announced the Board of Directors’ decision to increase and extend our ongoing open market share repurchase authorization by an additional $500 million through 2017. Most recently, in February 2015, we increased our quarterly dividend 12 percent to $0.19 per share, the fifth dividend increase in the last four years.

While we are proud of our achievements, we are even more excited by what lies ahead. We are still only in the second phase of the Growth Game Plan, and there is much more opportunity in front of us than we have realized to date.

Looking ahead to 2015 and beyond, we will continue to tackle unnecessary complexity in our business, reduce our overhead structure and drive productivity across the portfolio. Our clear line of sight to these additional cost savings bolsters our commitment to step up brand support significantly again in 2015, with further increases to come in subsequent years.

We have considerable runway to expand our business internationally, leveraging the success of our Win Bigger businesses in Latin America to build repeatable models that we can replicate across the globe. And we will continue to make even sharper choices as we strengthen, focus and scale our portfolio. This will help us reach our goal of consistently delivering greater than 4 percent core sales growth and more than 10 percent normalized earnings per share growth when we enter the Acceleration phase in 2016.

In a few short years, Newell Rubbermaid has become a faster-growing and leaner business, investing in our brands at record levels and winning in the marketplace in the U.S. and overseas. This transformation has only been possible thanks to the continued support of our shareholders.

On behalf of my colleagues at Newell Rubbermaid, thank you.

Michael B. Polk

President & CEO

*Please refer to the Corporate Information section for information regarding forward-looking statements and the use of non-GAAP financial measures.