Today, Mohawk is in the strongest position in our Company's history. Our strategy is to leverage this position to grow profitability and return more value to our shareholders. We have a clear, long-term strategy in place to do so.

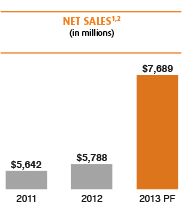

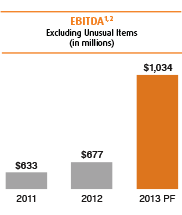

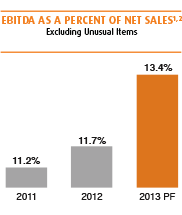

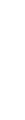

In 2013, Mohawk delivered exceptional growth in net sales and profits while simultaneously strengthening our U.S. market position and expanding our presence around the world. We leveraged our strong balance sheet to focus on an aggressive growth strategy, investing $1.8 billion in acquisitions. Through these acquisitions and continuing growth and productivity in our legacy businesses, we strengthened our market positions in the United States, Europe and Russia and further diversified our exposure to key international markets.

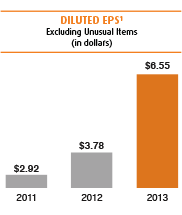

Our excellent strategic position is translating into some of the strongest financial results in company history. In 2013, earnings, excluding unusual charges, climbed 73 percent

to $6.55 per share. Net sales increased 27 percent during 2013 to reach $7.3 billion. Further underscoring the strength of our enterprise, Mohawk Industries was added to the

S&P 500 during 2013.

In many ways, 2013 was a transformational year for Mohawk. As recently as 2006, 88 percent of our net sales were derived from North America, and carpet accounted for approximately 60 percent of our business. Today, more than 30 percent of our net sales are generated outside North America, led by sales in Europe and Russia. And our net sales mix also changed to now roughly 40 percent carpet, 40 percent ceramic and 20 percent laminate and wood. While we worked diligently to maximize the value of our acquisitions, we continued to make productivity improvements across all of our businesses, reducing costs and increasing margins. During the year, we drew upon two decades of experience, successfully integrating businesses to maximize the value of three acquisitions in seven countries while continuing

to make productivity improvements across the enterprise, reducing costs and increasing margins.

Our focus on growing the business has not been limited

to acquisitions. In 2013, we invested $367 million in capital projects, including fiber innovation, ceramic capacity, an insulation board facility in Europe and significant improvements to the productivity and efficiency of our newly acquired businesses. In 2014, we plan to invest an additional $500 million to enhance capacity, innovation and productivity. Our ongoing investments position us to capitalize on continued growth from pent-up demand in new construction and remodeling in the U.S., as well as the expected recoveries in the U.S. commercial end market and the international economies in which we operate. The domestic recovery has included a rebound in new construction, and accelerated spending in residential-remodeling. Residential products account for approximately three-fourths of U.S. flooring sales. Residential remodeling, which represents more than 50 percent of U.S. flooring, is being driven by pent-up demand from postponed projects, stronger consumer sentiment, higher housing prices and growing sales of existing homes. As a result of these dynamics, U.S. flooring industry growth should outpace U.S. GDP growth. We expect similar trends in Europe as the recovery in that market gains strength.

Carpet: Capitalizing on Product Innovation

Our carpet segment is positioned ideally to benefit from a rebound in U.S. residential remodeling as consumers invest in upgraded products to personalize their homes. We have become the leader in next-generation soft fibers by focusing intently on product innovation. Our exclusive SmartStrand® Triexta offering pioneered the super soft carpet category, pairing luxurious fiber with exceptional stain resistance, and we led the industry into super-soft nylon with our Wear-Dated® Embrace™ and Allure™ collections. We are replicating this strategy in the more value-oriented and fast-growing polyester segment, providing differentiated collections in a category that has historically been dominated by commodity products. We have introduced more than 40 new products in this category, utilizing a new proprietary manufacturing process called Continuum™ that delivers enhanced stain resistance and superior appearance, while allowing for

100 percent recycled content.

While we have led the industry in product innovation, we have also invested heavily in process enhancements that have significantly improved our productivity and quality, added efficiencies in our national logistics network and reduced our waste. During 2013, fourteen of our carpet and rug manufacturing facilities achieved "Zero Landfill" status, eliminating or up-cycling all waste generated in the facilities. We will expand this program across the enterprise to reduce our costs and do the right thing for our communities.

Ceramic: Integration and Global Expansion

Our ceramic segment delivered exceptional results in 2013, driven by the addition of Marazzi, improved domestic product mix from innovative new collections and increases in new U.S. home construction — which accounts for a higher percentage of end-user purchases in this category. The acquisition of Marazzi transformed Mohawk into a global ceramic leader. We gained the leading market position in Russia, where our participation in the supply chain runs from manufacturing to distribution to retail. We are leveraging design and technology innovation across the enterprise and upgrading European assets to enhance product mix and productivity. We are well positioned to increase the growth of our ceramic sales given the competitive strengths of our leading-edge design, the scope of our product offering and the variety of our distribution channels.

We moved rapidly in 2013 to leverage the many synergies that the Marazzi acquisition provides. In just nine short months, our team has already realized enhancements in operations, sales and product development. In the U.S.,

we merged Marazzi with our existing Dal-Tile operations

to optimize sales channels, enhance product design and drive operational and administrative efficiencies. We also appointed a new European management team and implemented a more efficient and effective pan-European sales and operating strategy to replace the previous country-by-country approach.

We are marrying the leading-edge design and technological innovations from Europe with our existing strengths in manufacturing and distribution to deliver superior products, value and service. Going forward, we will leverage our global ceramic assets across all markets to optimize our product offerings, exploit the flexibility of our production

and take advantage of our superior cost structure.

Laminate & Wood: Consolidated Strength

Our laminate and wood segment delivered strong results

in 2013, with growth through acquisitions and increased sales in the U.S. across all categories and channels offsetting the impact of a soft European economy. As in ceramic, the integration of acquisitions is creating opportunities with our existing Unilin business on both sides of the Atlantic. The newly acquired and highly regarded Pergo® laminate brand was a perfect complement to our existing Quick-Step® brand and its industry-leading technical innovations. Combined, these two premium names provide us with leading laminate positions in Europe and the U.S. In both markets, Pergo's significant position in the home center channel balances Quick-Step's leadership in the specialty retail channel. During the year, we moved quickly to consolidate manufacturing, sales and administrative infrastructure in the U.S. and Europe, and we are driving value for the business and consumers by enhancing each brand's product portfolios through industry-leading design, patented installation systems and extensions into the hardwood category.

In recent years, luxury vinyl tile ("LVT"), a relatively new flooring product that provides a look similar to laminate but with different performance attributes, has been among the

fastest-growing categories in our industry. We are currently building a new LVT manufacturing facility in Belgium to create

a product line that features our patented installation system. We are actively increasing LVT sales in both Europe and the U.S. to support this facility's capacity. Our technical, design and installation expertise in laminate is applicable to LVT, and we can leverage these strengths to establish a leading position in this rapidly expanding category in the U.S. and Europe.

Best Today, Better Tomorrow

With good progress in the integration of our recent acquisitions

we are balancing our focus between maximizing the return of our existing businesses and exploring the many different growth opportunities in the U.S. and around the world. We remain committed to delivering value to our more than 25,000 customers through innovative products and exemplary service and to

process innovations that enhance the quality, efficiency and productivity of our operations. With an established presence

on five continents, we are expanding our participation in those markets and product categories that offer the most compelling growth potential, whether through acquisitions, joint ventures

or "green fielding."

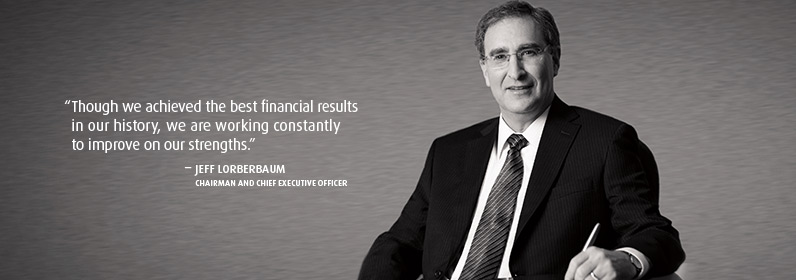

There is a saying at Mohawk, "We're halfway there." Though

we achieved the best financial results in our history, we are working constantly to improve on our strengths. Our objective is to operate our business better, faster, smarter and at a lower cost every day. Each of our businesses now has the strongest management ever, and all of our teams are driving well-defined, long-term growth strategies to expand margins, introduce innovative products, improve productivity, quality and service and, most importantly, create value for our shareholders.

Thank you for your support of Mohawk during 2013. We look

forward to further rewarding that support in the great future

that lies ahead of us.

Jeff Lorberbaum

Chairman and Chief Executive Officer