Download 2014 Annual Report PDF

Since our initial public offering, we have delivered total shareholder return through 2014 of 1,722%

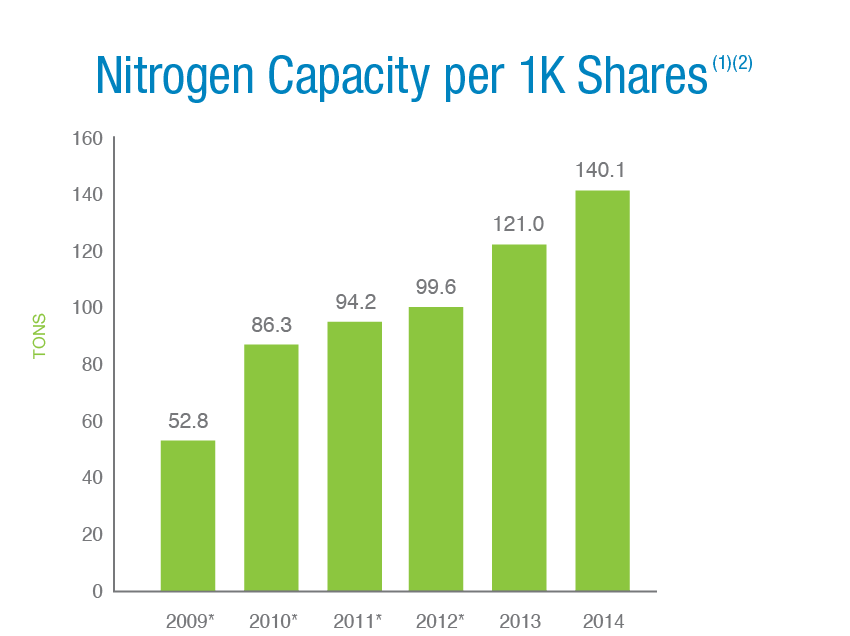

We invest in high-return projects that increase our nitrogen production capacity. As these projects begin to generate cash flow, we can further increase our debt capacity, which, in turn, can be redeployed on behalf of CF Industries' shareholders.

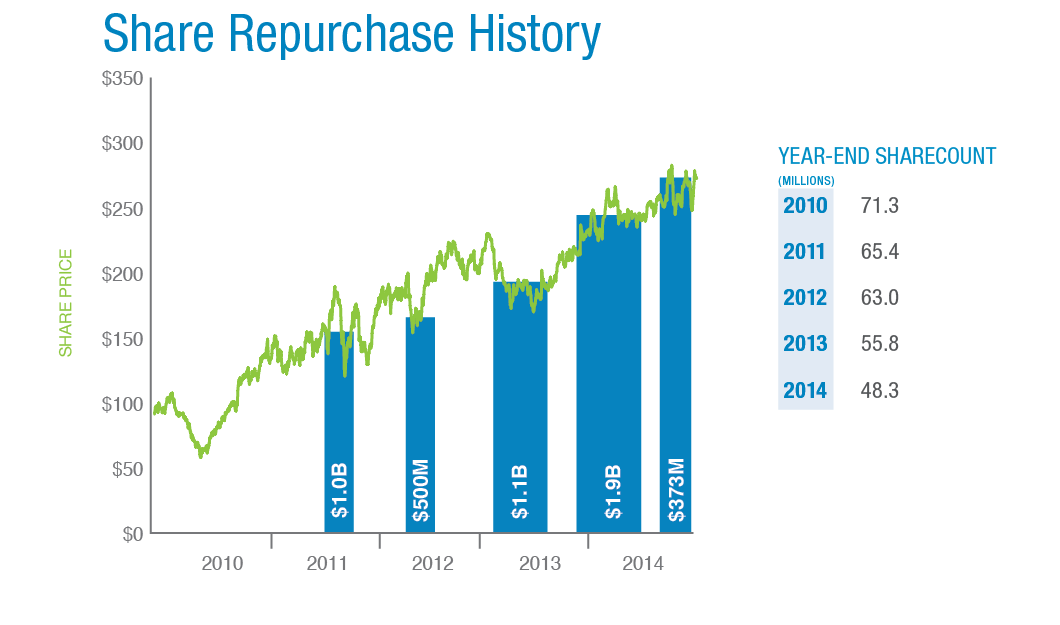

Returning excess cash flow to shareholders is a priority. Since 2010, when CF Industries issued equity to partially finance the acquisition of Terra Industries, we have repurchased nearly one-third of shares outstanding.

As we increase the amount of nitrogen tons we have to sell, we increase our cash flow generation potential. Our strategy is to deploy cash to expand capacity and to repurchase shares in order to drive the ratio of the cash flow-generating capability per share as high as possible.

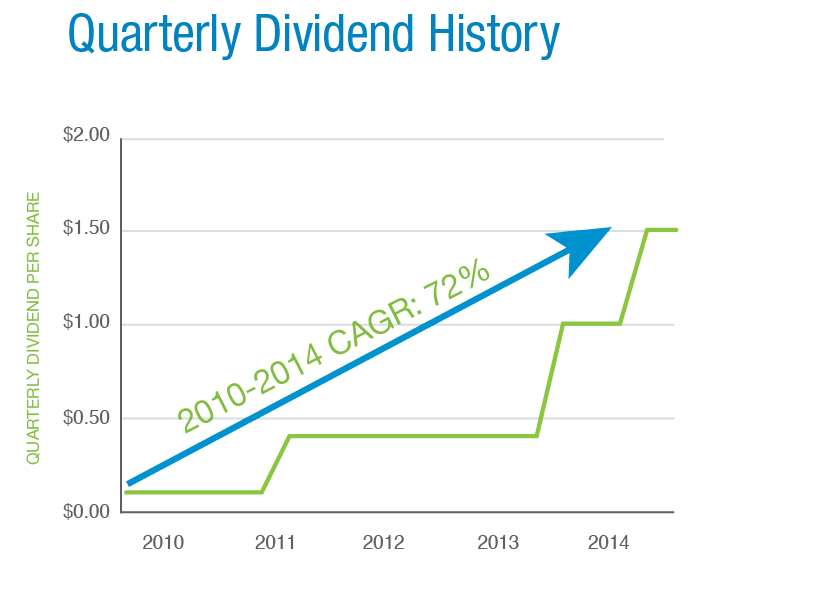

We utilize dividends to help drive total return. Over the past five years, we have grown our dividend at a compound annual rate of over 70 percent.

(1) Includes 50% joint venture interests in facilities located in Point Lisas, Trinidad; Ince, U.K.; and Billingham, U.K. Nitrogen capacity as 82% of gross ammonia capacity stated per 10-K for each filing period.

(2) Shares outstanding as indicated on the cover of the 10-K for each filing period.

* Excludes the 34% of Canadian Fertilizers Limited (CFL) that was owned by Viterra prior to April 30, 2013, when CFL became a wholly owned subsidiary of CF Industries.

Crop nutrition to optimize yield requires precision: applying the right nutrient at the right rate in the right place at the right time. The same is true of our own business: optimizing profitability demands the highest standards of operational excellence, safety and environmental stewardship. Our commitment to these standards is reflected in record high ammonia shipments and a record low recordable incident rate during 2014.

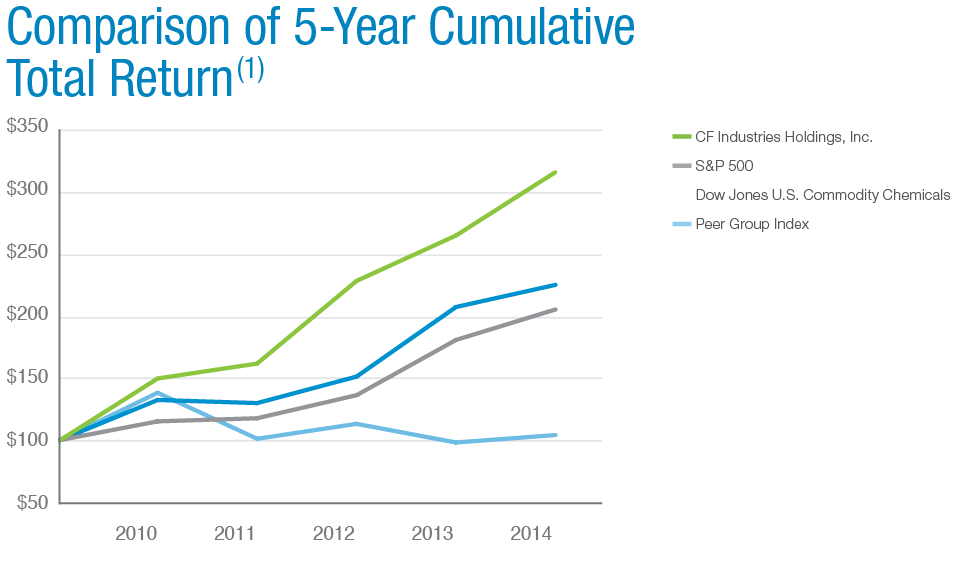

(1) The graph above shows the cumulative total stockholder return, assuming an initial investment of $100 and the reinvestment of any subsequent dividends, for the period beginning on January 1, 2010 and ending on December 31, 2014. The chart tracks our common stock, a peer group, the Dow Jones United States Commodity Chemicals (DJUSCC) Index, and the Standard & Poor’s 500 Index, of which CF Industries Holdings, Inc. is a component. In constructing our peer group, we have selected Agrium Inc., The Mosaic Company, Potash Corporation of Saskatchewan Inc. and Intrepid Potash, Inc., all of which are publicly traded manufacturers of agricultural chemical fertilizers with headquarters in North America. We have assumed the initial investment of $100 in the peer group was allocated among them on the basis of their respective market capitalizations at the beginning of the period.