This is Our Place — the 16 states we serve from Texas to Indiana to Florida — and its progress makes it among the most attractive places to do business in America. For Regions, the positive demographic and economic forces at work in Our Place are a source of strength. Today we’re building on that strength with a growth strategy fueled by innovation, empowered by personal service and supported by a culture that puts customers and communities first.

Learn more about Our Place right here.

Regions’ branch network provides the foundation for face-to-face interactions where our bankers create and deepen relationships. Branches also establish a local presence and connect us with communities. They also play a central role in generating loan and deposit growth, with more than 80% of our sales occurring in a branch. Today we’re doing more to optimize our network – making sure we have the right locations, footprint, staffing levels and technology to increase operational efficiency while maintaining high levels of customer satisfaction.

Flagship Branch

Flagship Branch  Neighborhood Branch

Neighborhood Branch  Micro Branch

Micro Branch Unmanned Branch

Unmanned Branch Flagship branches, our largest at between 8,000 and 10,000 square feet, are sited in visible, high-traffic, prime locations. Their larger staffs are focused on customer service and sales, and they offer a full line of business services and wealth management expertise.

Our newest format, the micro branch, at 1,000 to 2,500 square feet, is built around the universal banker concept. These highly automated facilities feature advanced technology, including video tellers, for routine transactions, and universal bankers are on hand to perform more value-added services.

Sized between 2,500 and 4,000 square feet, our neighborhood branches offer robust capabilities in a smaller footprint. Advanced technology plays an important role, and several employ the “universal banker” concept – where all bankers can execute a full suite of services, from simple check cashing to mortgages and business loans.

Providing ultimate convenience for customers was key when developing our unmanned concept. Located on major highways with an abundance of traffic, this model has multiple ATM and Video Teller Machines.

Our innovative universal branch concept and advanced technology are delivering for customers in West Lafayette, near the campus of Purdue University. Click to learn more.

Healthcare

Healthcare Energy & Natural Resources

Energy & Natural Resources Restaurant

Restaurant Technology & Defense

Technology & DefenseCorporate banking clients at small to mid-cap companies value working with bankers who have a deep understanding of the unique needs and requirements of their business. That client-centric focus, coupled with our geography presence and relationships, drives the success of Regions Specialized Industries. This group is a strong contributor to our overall success and is helping us achieve our growth objectives. During 2014, the Specialized Lending Group achieved year-over-year loan growth of 13%. Over the last four years, the Specialized Industries group has generated a Compound Annual Growth Rate (CAGR) in revenue of approximately 20%. Our Specialized Industries team is comprised of bankers with extensive experience — professionals who can provide insightful industry guidance on a range of customized solutions to meet our clients’ strategic and financial objectives. These specialty areas include: healthcare, energy and natural resources, restaurant, technology and defense, transportation and logistics, and financial services.

Whether the client is a cyber- security provider, an operator of data centers or a defense contractor, the Regions Technology and Defense Group has experienced industry specialists who deliver a full suite of integrated services. Our relationship-oriented approach serves a broad array of clients, from founder and venture capital- backed firms to leading publicly held companies.

The Regions Healthcare team is a recognized leader in small and mid-cap healthcare, tax-exempt hospital finance and medical office building project finance. Our seasoned group of bankers has significant depth of experience providing healthcare companies with advice on capital structure, risk management and capital markets accessibility.

Regions has been a leading bank to the energy and natural resources industry for more than four decades. Today we have more than 200 U.S.-based energy and natural resources clients – from upstream and midstream energy sectors to power and utility companies. Our capital markets experts and in-house petroleum engineers average over 30 years of experience and understand the nuances of the energy industry.

Bankers in the Regions Restaurant Group leverage their industry expertise on behalf of national brand franchisees, franchisors, restaurant operating companies and private equity groups with a retail and consumer focus. Our team offers a thorough understanding of market conditions and provides the guidance and solutions necessary to execute growth and strategic plans.

Learn how Regions foresters help landowners increase the productivity of timberland assets.

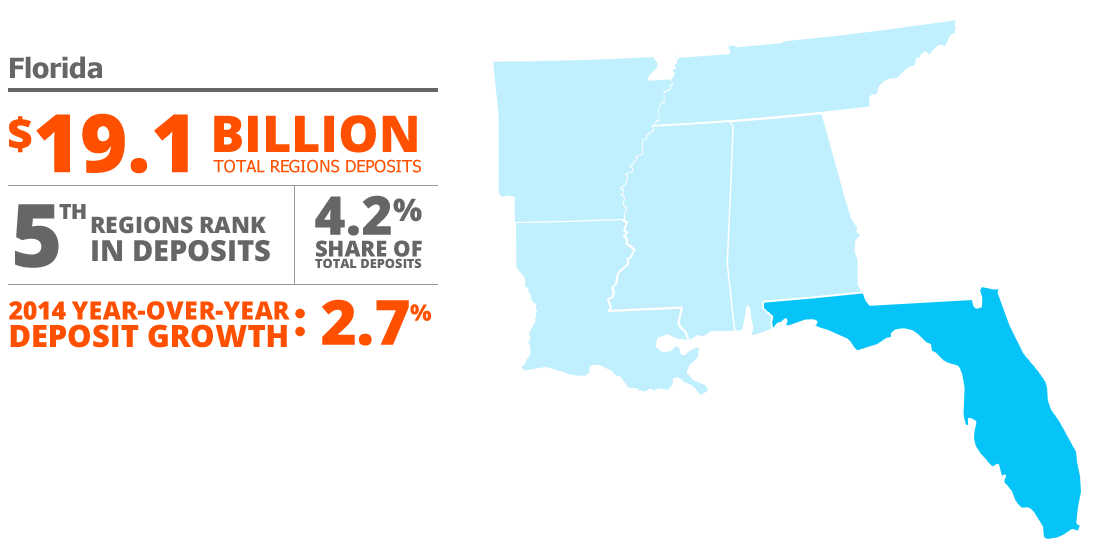

We’re focusing our investments on select markets that possess the most attractive potential for continued growth. These dynamic metropolitan areas are characterized by significant growth in population, deposits and business activity.

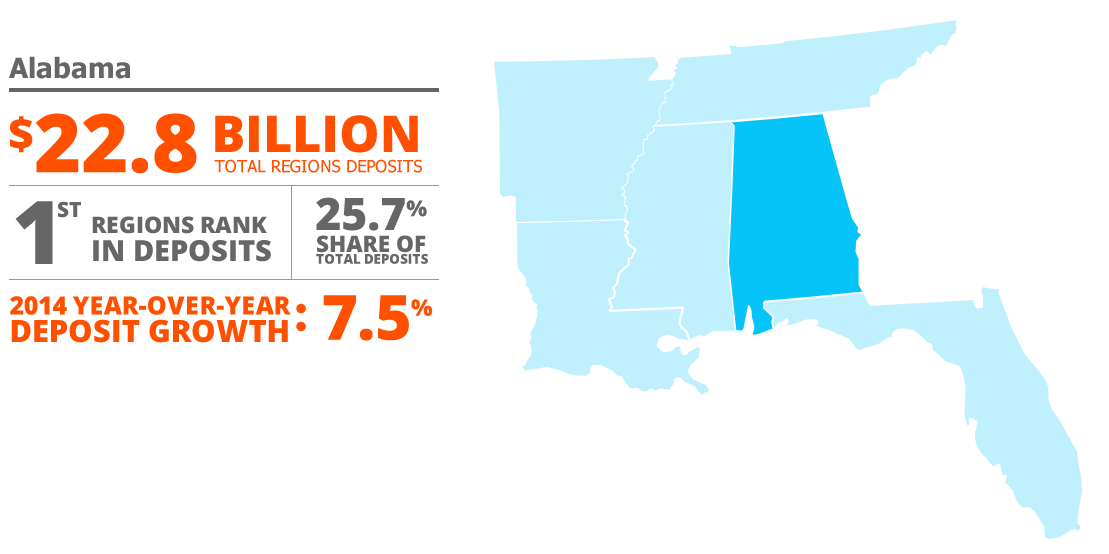

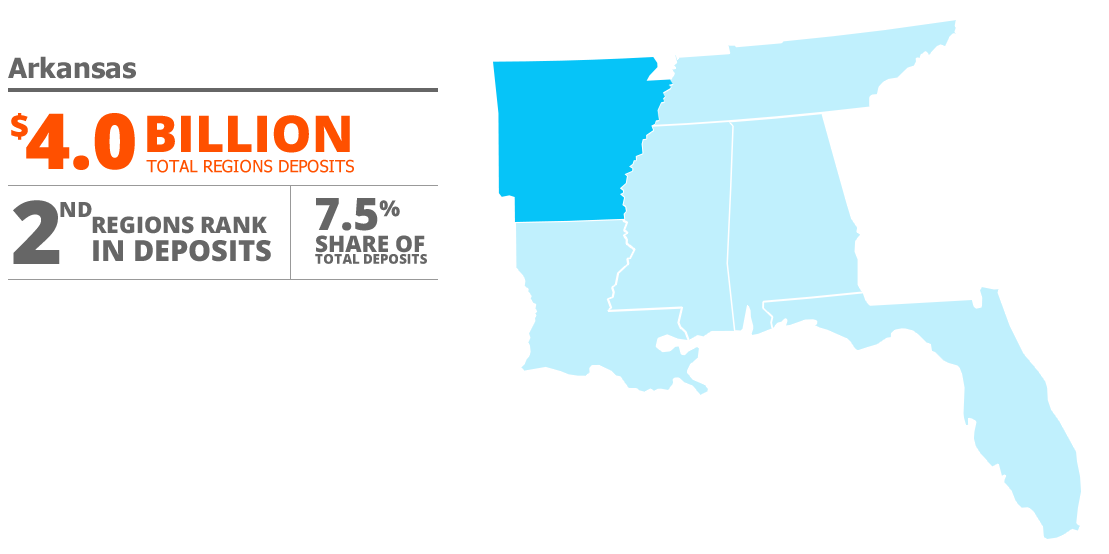

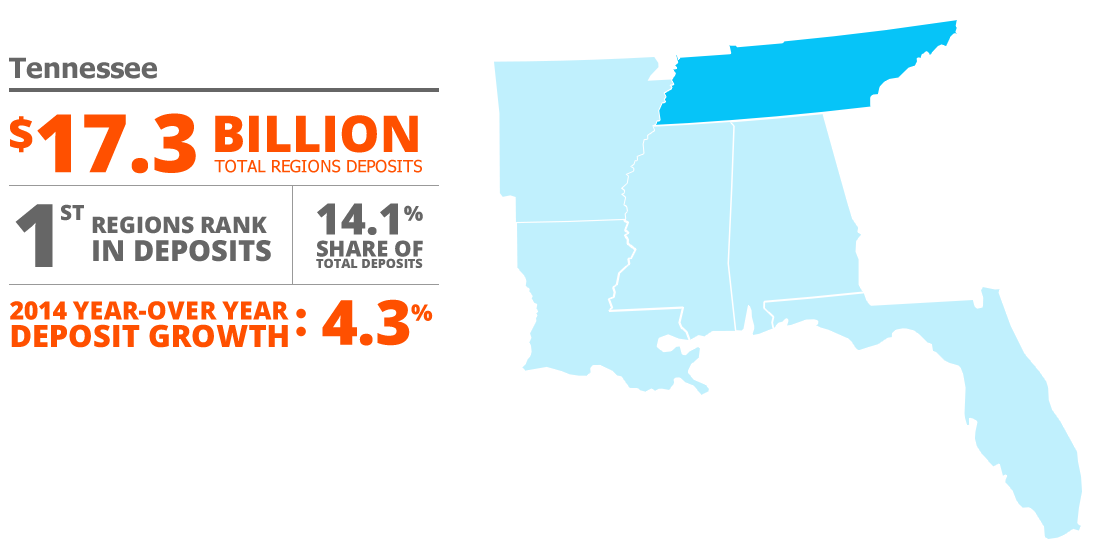

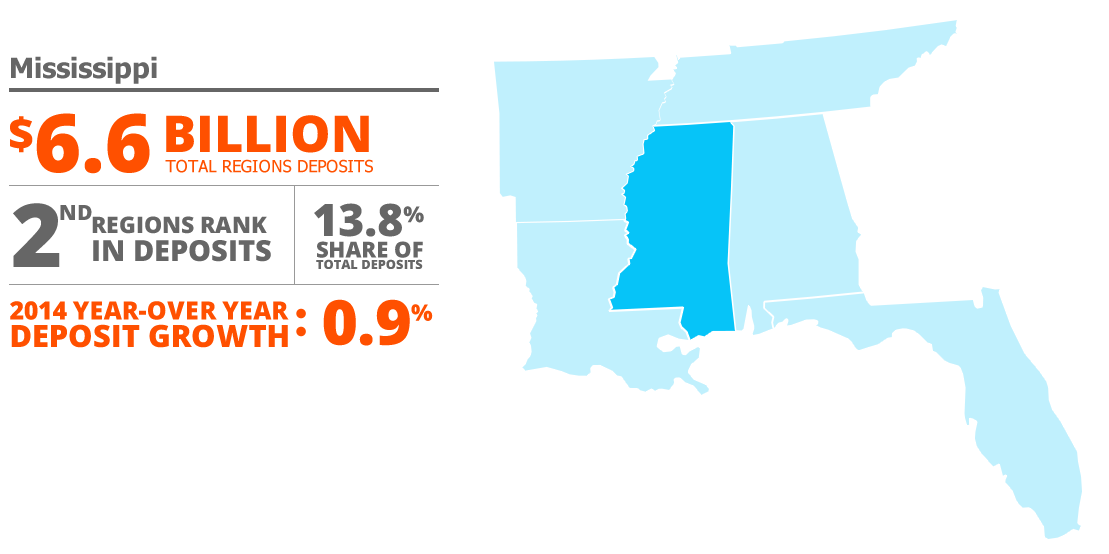

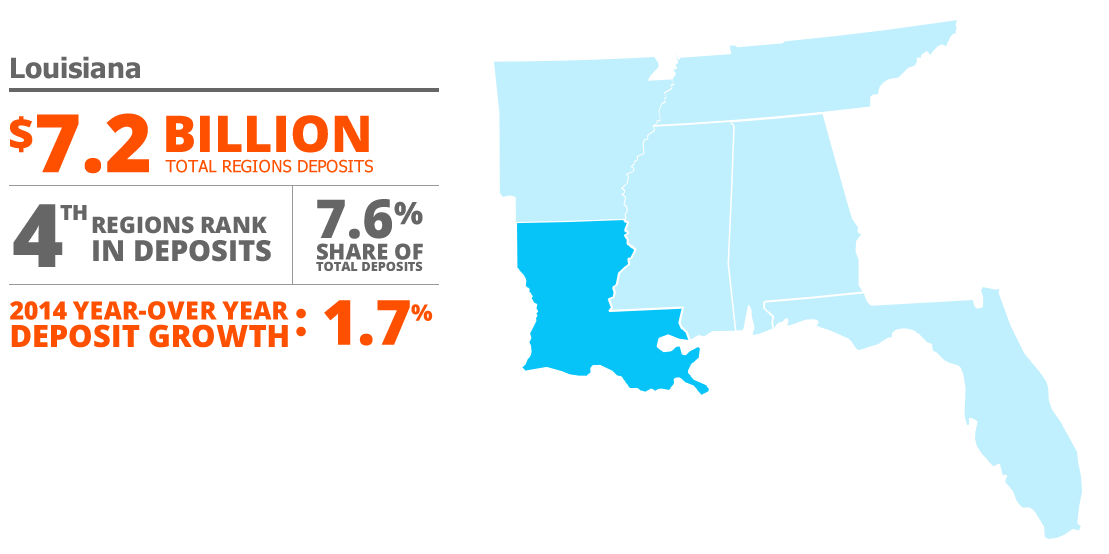

Our growth strategy is supported by a solid foundation of market share dominance and deposit growth in our core states. Regions’ strong competitive position in our core markets helps provide the financial capacity to execute our growth strategies. Our ability to grow low-cost deposits while having a loan-to-deposit ratio of 82% is a considerable funding benefit as well as a fundamental competitive advantage.